All Topics / Opinionated! / THE COMING ECONOMIC CRISIS GET READY!

Hey Freckle,

Survived the aftermath of an enjoyable celebration, paid the price and now recovered.

Interesting.

I have little doubt the USD is systematically being pushed from it's status as a global currency. We can clearly see that is happening as China is proactively negotiating and implementing trade agreements with a number of nations including oil producing countries and destabilising the US Petrodollar cycle.

China, as I'm sure you know, is importing huge amounts of gold through Hong Kong and also encouraging it's citizens to hold gold. We'd also have to acknowledge that China is the biggest producer of gold and the vast majority of this product stays in China not to mention gold that is illegally smuggled into the China.

In relation to Chinese citizens being encouraged by the state to hold gold, one argument put forward is that this obviously increases to influx of gold into China. If we look back into history there are a number of nations, including the US, that have then passed laws restricting the holding of gold by private citizens. The state takes back the gold and backs it's currency against the gold standard. It would not surprise me at all to see the Renminbi backed by gold and a global currency sometime in the next decade.

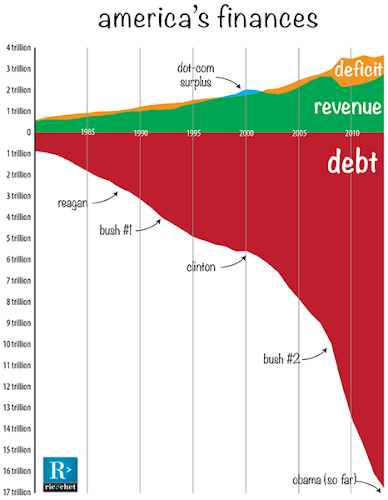

It'll be interesting to see how the US is going to reduce QE if it ever does at all. It may have missed it's best opportunity last month when a taper was already priced into the market. Conveniently we saw the government go into spasm over raising the debt ceiling and as a result disrupt economic data forcing the fed to delay any thoughts of tapering the 85 billion a month it's printing and pumping into the system. What's also 'convenient' is that we'll see it all happen again early in 2014…..!

One things for sure, someone somewhere is getting richer by the second.

It's pretty obvious where this is going… not too long now I'm thinking

Last night the Dow Jones rallied to fresh all time highs on WEAK economic data out reassuring investors that the fed will continue with its aggressive quantitative easing policies pumping US$85b of hot money into the system further encouraging people to enter a toppy share market in the search of higher returns. BEWARE ITS A HOUSE OF CARDS!

When and if the world packs in, what’s more likely to suffer the most, shares or property?

I'd suggest that if there was a black swan event, and I would again suggest it would be originate from the US, money would flow out of the stock markets as the herd stampedes in a panic trying to get their money out the market taking it lower and lower as the fat fingers push the 'sell at market' button in desperation. If you look back into history when it happens it happens in a day and the smart money is usually out the previous day leaving the rest of us to only watch on in horror as the market corrects…and they short it down because someone's going to make money out of it

jmsrachel wrote:When and if the world packs in, what's more likely to suffer the most, shares or property?Both but for different reasons and as a market corrects that doesn't mean all assets correct equally. Systemic and/or strategically important assets will decline the least if at all. Some may in fact appreciate. The next phase is how asset classes recover. Some will continue to decline others will bottom out and drift sideways and others still will rebound to some extent as the system rebalances and finds its new equilibrium.

In terms of property if a correction were to hit then how much a particular property class/region/area/suburb might correct would reflect it's current distance from trend and how much leverage owners/investors have relative to that category.

Well I guess all we can do now is sit and wait. Reminds me a bit of that movie deep impact.

jmsrachel wrote:Well I guess all we can do now is sit and wait. Reminds me a bit of that movie deep impact.Why not profit from it….?

Someone always has to profit Joe.

Market corrections are either devastating for some or an opportunity to take advantage for others…

There are clues to opportunity. You only have to look back in history to the dot-com bubble in 2000-2002 and more recently to the 2007-2009 correction.

The very simplistic equation is: Massive monetary printing causing systemic currency debasement injecting hot money into the stock market, money that has not reached other parts of the US economy where it is needed, sends global stock markets soaring to new highs on extremely weak economic data. Higher and higher we go yet the economic fundamentals are weak and anemic. The fed is disparately trying to inflate the balloon. The higher we go the bigger the fall because the market will always settle at its intrinsic value.

The clues IMHO are there even here in Australia in bright lights, flashing…. Even in politics. Joe Hockey no sooner steps off the plane from his 'secret' meeting with the central planners of the globe in Washington and he's pumping AU$8.8b into the RBA stating, "The rise in the value of the Australian dollar has inflicted heavy losses on the Reserve Bank, which is required to hold sufficient foreign exchange reserves to manage any extreme movements in the currency market….Australia's economy is still growing but trouble lurks on the world stage. We've got some headwinds coming out of the US in early next year and headwinds coming out of Europe."

But the stock markets are at all time highs! How can that be Mr Hockey…

Danger Will Robinson!

I've never been one to understand the share market. Most people that i know that have invested in shares have always lost big time.

But you are right, for those that know what they are doing it probably is the right time to make some serious dollars

jmsrachel wrote:Well I guess all we can do now is sit and wait. Reminds me a bit of that movie deep impact.AU is likely to take the least damage and should recover faster than others due to much smaller debt load and economy that is at least partially supported by stuff others want.

As long as you keep your leverage below 60% and can take a 50% asset depreciation hit while still retaining positive cash flow you should be alright in even the worst of situations.

If your even close to negative gearing you're a goner.

Freckle wrote:jmsrachel wrote:Well I guess all we can do now is sit and wait. Reminds me a bit of that movie deep impact.AU is likely to take the least damage and should recover faster than others due to much smaller debt load and economy that is at least partially supported by stuff others want.

As long as you keep your leverage below 60% and can take a 50% asset depreciation hit while still retaining positive cash flow you should be alright in even the worst of situations.

If your even close to negative gearing you're a goner.

Are you just talking about shares or property or BOTH?

Wouldn’t every one just file for bankruptcy and clear the debt? I can’t see how my $600k ip 15km to the cbd will only be worth $300?

Bonham wrote:Are you just talking about shares or property or BOTH?

Property.

jmsrachel wrote:Wouldn't every one just file for bankruptcy and clear the debt? I can't see how my $600k ip 15km to the cbd will only be worth $300?The next event will look much like the GFC in 07/08. However, it will be broader deeper and more pronounced than the last. Any recovery could take decades if ever (in our lifetimes). The problem this time around is that exponential population growth is stripping resources faster than we can replenish them or find substitutes for them. Over the next 30 years energy supply will not meet demand by a significant amount based on current discovery rates verses depletion rates coupled with extraction/supply rates. Most western countries have been bumping up against energy supply limits for a decade or more.

The other obstacle is food production. We haven't progressed food production in line with population growth. The reality is that for all the tech breakthroughs we aren't keeping up and in fact may be boxing ourselves in with mono culture ag practices. It is estimated that the world needs to double food production within 25 years. We've never been able to do that and with an energy and fertiliser shortages on the horizon the outcomes does not look good.

One of the largest sources of protein for many populations is marine. In my lifetime I've personally seen anecdotal evidence of desertification of marine coastlines in NZ. Pollution, over fishing, climate etc are on track to cause a global collapse in marine ecosystems by 2050.

Many people choose to ignore these challenges and problems because they are either ignorant of the facts or simply choose to not see because the consequences are too dire to cope with emotionally. The ostrich syndrome. If I don't know about it, can't see it or simply ignore it it will somehow go away.

The reality is that these problems are coming and the cause is population nothing else.

These challenges are bad enough but while some wonder about asteroid impacts causing problems we have our own lethal problem brewing under our noses, nuclear waste. People should educate themselves about Fukushima to get their head around that problem. What most people don't realise is that Fukushima has the potential, if it goes wrong, to destroy virtually all life on this planet. Currently we a have waste storage pool (reactor 4) containing several hundred tonnes of spent fuel rods sitting in damaged cradles suspended under water in a building that has been partially destroyed by earthquake, tsunami and hydrogen gas explosions. This pool of waste fuel rods is suspended 3 floors up and is held in place by a series of jack studs to prevent the pool from collapsing and spreading spent fuel rods all over the place. Just this pool alone has the potential to release radioactive contamination equivalent to 14,000 Hiroshima's. That pool of fuel rods will start cooking off the second they are exposed to air. It will take down its neighboring reactor which has roughly the same amount of fuel rods. They will in turn start cooking off and then we have the remainder of the site that has literally another 1500+ tonnes of spent fuel rods stored on site.

One expert described the problem in fixing this as almost impossible. The fuel rods are stacked in cradles underwater and where positioned by computer controlled cranes that work to tolerances of a mm. Those cranes (30t) are currently sitting in the pools in a tangled mess with half the building collapse in on them. The expert described extracting these fuel rods for safe storage like pulling wet cigarettes out of a crushed packet without breaking them – good luck with that. So while everyone tries to figure out how to make Fukushima safe without destroying the world the rest pray that another earthquake won't finish the job off in the meantime.

If Fukushima goes off it's basically game over. It isn't stoppable. It would be so bad they're even talking about basically evacuating the northern hemisphere. Impossible I know but people will flee none the less. The estimates are that the southern hemisphere will last around 10 years before it too succumbs.

Fukushima aside we have the problem of another 400+ reactors around the world plus another 400 on the drawing boards that produce huge quantities of fuel waste that has to be contained in water pools to prevent them going off. We only have to do this for 100, 000 years. No problem I'm sure they're all stored in safe locations away from earthquakes, floods and highly skilled tech's watch over them day and night with upto date monitoring systems.

Hey Freckle,

Those leveraged below 60% which I would say is very very few of us- why would we be in dire straits should the economy fall into a black hole? Unlike shares the banks cannot margin call and expect us to add surplus funds to maintain a new LVR respective of the new market value following a significant correction can they? I haven't heard of it happening in previous market downturns.

I don't see how properties in the lower quartile of the market below the 250-300k mark in quality locations could take such a hit when population growth and housing demand in key areas continues to influence their respective pricing? With strong demand for affordable housing, low vacancy rates, population growth beyond the Aust average and significant spending by LGA's on new amenities and infrastructure- how could prices retract to the degree you forecast for a period any longer than it takes for the market to settle down?

If investors across Aust were to take a 50% hit via asset depreciation on their property balance sheet, I would assume many would just pull the pin and declare bankrupt as Joe said which I cannot see happening- your thoughts?

These are the sorts of buffers you need to ensure survival. That doesn't mean I predict any sort of specific effect. No one really knows.

The problem with leverage is you have to service it. You have to have some capacity to soak up interest rate rises and defaulting renters/vacancies. 80% of PI's can't even withstand a mild financial event let alone what's coming. There are many here who are sitting on negative CG and pumping literally 1000's into dud investment properties.

I've said several times I believe the bottom 1/3 of the market offers the safest position simply due to the fact in a crunch many move down a peg or two. Demand focus will shift to the lower end of the market out of pure necessity.

Prices won't change uniformly. Just like the last GFC they will vary across all segments.

You must be logged in to reply to this topic. If you don't have an account, you can register here.