All Topics / Overseas Deals / Commercial Real Estate in the USA

In the name of everything that is holy and sacred what is this drivel?

I have to hand it to you John or Rob – you keep getting taken to the cleaners and you just keep coming back for more. You have skin thicker than a rhino's backside.

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

Commercial lending for all in coming back.

I would not necessarily say Florida leads the nation on the best financing of CRE but I do know that Florida is among the top and increasingly growing stronger. Here are three examples of aggressive lending in CRE. By the way EVERY BORROWER was a FOREIGN NATIONAL

1. 30,000+sf Retail Shopping Center priced at $5.2M located in the Tampa, Fl area: Buyer was from India. The LTV was 70% with 30-year amortization @ 4.25%. The lender is a life insurance company allowing non-recourse financing.

2. 5000sf Auto Tire Store priced at $1.9M located in the Jacksonville, FL area. Buyer was from Canada. The LTV was 70% with 15-year amortization @ 4.10%. The lender is a different life insurance company allowing non-recourse financing.

3. 82,000+sf Retail Shopping Center priced at $6.8M located in the north Orlando, FL area. Buyer was from China. The LTV was 70% with 25-year amortization @4.85%. The lender is a local community bank..

For historical purposes, these borrowers would not have been able to obtain this type financing a year ago. The market is changing in a good way on every front. And just to clarify, not every situation has to be a $-million plus deal to get this type financing. The facts are that some lending institutions have an appetite for larger deals but there is many financing possibilities for deals of all sizes and borrowers from all backgrounds.

John-USA-CommercialRE

Email Me

And the bargain bin state is……… yep. Florida!!

Don’t worry freckle good ol America will bounce back, even harder then before!

This link should display all the above graphs and many more. Each graph has an accompanying summary.

http://www.loopnet.com/Orlando_Florida_Market-Trends?linkcode=31070

A word of caution. The graphs are quite informative in describing the collapse over several years in all forms of RE and associated rental returns. They are current to Sep 12 so are reasonably recent. The market appears to have bottomed for the time being. That would be expected as sales have increased as prices have fallen. Less time on market, fewer properties on market, increasing rents etc. There now seems to be some equilibrium in the market.

The interesting point for a buyer is what the graphs don't tell you. Why was their such a cascading failure in CRE prices. CRE requires commercial tennants who have viable businesses. While the market may be keen to snap up cheap commercial one still has to find commercially viable tennants. There-in lies the rub.

If you believe the recovery story and also beleive that a recovery would be enduring then jump in with boots-in-all. If not….

jmsrachel wrote:Don't worry freckle good ol America will bounce back, even harder then before!I know.

I believe there will be a recovery but 15 years away at best. Too much damage has been done for it to recover any time soon. I just don’t get why spruikers keep flogging a dead horse,

jmsrachel wrote:I believe there will be a recovery but 15 years away at best.Hate to shatter the illusion Joe but we haven't had the crash yet. 08GFC was just the first signs the system was breaking. We've done nothing to rectify the causes of that event. On the contrary. Things are now much more fragile and the correction when it comes will be many times more severe. If anything all 08 did was ever so slightly uncover the political, corporate and criminal fraud within the system. As we progress down the timeline more and more of this fraud is being exposed but with a political class entwined in the fraud nothing is improving. If anything it's getting worse.

Europe sinks further into the mire month by month. The US pumps US$'s into Europe's banks trying to keep it afloat because it knows when Europe goes the US will follow shortly after. China's fiscal position is a catch 22 for them. They're only holding on by printing as fast as the US and pouring that into malinvestment that is dragging it under as well. It's QE programs are a zero sum game that will pull us into the mire as well. Japan has just got the green light from the G20 to print to infinity.

We're in a full blown currency war as global economics conditions fail time and again to react to more QE. There is no escape now. It's just a matter of time.

When things finally do go pear shaped for real there'll be no recovery in 15 years. I doubt the world will see a recovery in my sons (30 & 27) lifetimes let alone mine. Over the next 50 years we have to deal with population growth, food production, energy shortages and global climate distress. Even healthy economies would struggle to deal with these events individually but a distressed global economy is somehow expected to mitigate these events as if they're manageable.

This year could see the first time ever we have no Arctic ice. It takes 1 calorie of energy to melt 1ml of ice. That same cal will raise 1 ml of water 80F. The amount of heat energy that is likely to be absorbed from the loss of snow covering is said to be of real concern. Historically 83% of global climate predictions have underestimated the outcomes. A developing consensus amongst some serious researchers is that a 2degC is now backed in. If we stopped all industrial activity today we couldn't prevent that 2degC rise. They are now talking of a NTE. Near Term Extinction

Since 1840 the sea has lost an estimated 90% of fish stocks and is expected to collapse by 2050.

Civilisations have spent the last 4000 years consuming the planet. None more so than recent western civilisations. We can't survive without killing our planet. It's that simple. We are nearing the end now of this earths ability to sustain a growing global population.

The economic reset is one of many that will occur over the next 50 years. The worst will be the population reset. The most pessimistic research that this could occur within 30 years but almost certainly within 100 years.

The only good news is that the northern hemisphere is likely to take the brunt of global warming weather events.

Ok I dont know how to respond to this

I guess if the world is coming to an end then there is not much we can do about it

However to suggest that the fall has not happened yet is nonsense. If a markets falls you have to look at the reasons. No one is arguing about the information that you have put up or the size of the falls. However markets recover

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

Nigel Kibel wrote:Ok I dont know how to respond to thisI'm shocked!!.

Quote:I guess if the world is coming to an end then there is not much we can do about itNot to worry Nigel it's unlikely you'll see it coming.

Quote:However to suggest that the fall has not happened yet is nonsense.Wrong end of the stick as usual. 08 was simply the early phase of the end of this current super cycle. QE initially arrested the descent and afforded limited stability to an abused economic system. QE is a like a blood transfusion. It can give you time to fix the problem but you have to actually fix it not fudge it. QE becomes less effective each time as the patient weakens. There have been many resets in the past. This is no different except that its taking longer and will be far more disruptive and painful than on previous occasions'. Food, water, population, energy and global warming will continue to complicate things and make sustained recovery difficult if not impossible.

.Quote:If a markets falls you have to look at the reasons. No one is arguing about the information that you have put up or the size of the falls. However markets recover

.Quote:If a markets falls you have to look at the reasons. No one is arguing about the information that you have put up or the size of the falls. However markets recoverMarkets may recover but not in my lifetime. And its really simple stuff to understand if you want to.

Populations are growing exponentially..

Energy demand grows along with it… the cost will be crippling financially and devastating from an environmental perspective.

We will need 50% more fresh water by 2050

China, with 1.26 billion people, is "the one area worrying most people most of the time," says Marq de Villiers, author of the recently published "Water " (see bibliography). In dry Northern China, he says, "the water table is dropping one meter per year due to overpumping, and the Chinese admit that 300 cities are running short. They are diverting water from agriculture and farmers are going out of business." Some Chinese rivers are so polluted with heavy metals that they can't be used for irrigation, he adds.

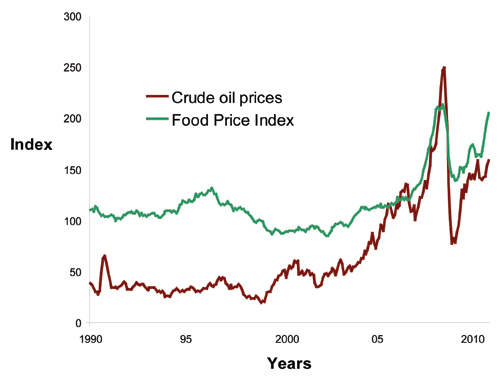

Energy and food costs will cripple poorer economies and constrain modern economies.

This is superficial information. Anyone who wants to can join the dots. It's easy to do hard to execute because most people want to stay ignorant of anything negative that may affect their blinkered lives. If I don't see it it can't hurt me mentality.

lol Thanks Freckle I will move to the moon it should be safer than Earth

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

Freckle wrote:jmsrachel wrote:I believe there will be a recovery but 15 years away at best.Hate to shatter the illusion Joe but we haven't had the crash yet. 08GFC was just the first signs the system was breaking. We've done nothing to rectify the causes of that event. On the contrary. Things are now much more fragile and the correction when it comes will be many times more severe. If anything all 08 did was ever so slightly uncover the political, corporate and criminal fraud within the system. As we progress down the timeline more and more of this fraud is being exposed but with a political class entwined in the fraud nothing is improving. If anything it's getting worse.

Europe sinks further into the mire month by month. The US pumps US$'s into Europe's banks trying to keep it afloat because it knows when Europe goes the US will follow shortly after. China's fiscal position is a catch 22 for them. They're only holding on by printing as fast as the US and pouring that into malinvestment that is dragging it under as well. It's QE programs are a zero sum game that will pull us into the mire as well. Japan has just got the green light from the G20 to print to infinity.

We're in a full blown currency war as global economics conditions fail time and again to react to more QE. There is no escape now. It's just a matter of time.

When things finally do go pear shaped for real there'll be no recovery in 15 years. I doubt the world will see a recovery in my sons (30 & 27) lifetimes let alone mine. Over the next 50 years we have to deal with population growth, food production, energy shortages and global climate distress. Even healthy economies would struggle to deal with these events individually but a distressed global economy is somehow expected to mitigate these events as if they're manageable.

This year could see the first time ever we have no Arctic ice. It takes 1 calorie of energy to melt 1ml of ice. That same cal will raise 1 ml of water 80F. The amount of heat energy that is likely to be absorbed from the loss of snow covering is said to be of real concern. Historically 83% of global climate predictions have underestimated the outcomes. A developing consensus amongst some serious researchers is that a 2degC is now backed in. If we stopped all industrial activity today we couldn't prevent that 2degC rise. They are now talking of a NTE. Near Term Extinction

Since 1840 the sea has lost an estimated 90% of fish stocks and is expected to collapse by 2050.

Civilisations have spent the last 4000 years consuming the planet. None more so than recent western civilisations. We can't survive without killing our planet. It's that simple. We are nearing the end now of this earths ability to sustain a growing global population.

The economic reset is one of many that will occur over the next 50 years. The worst will be the population reset. The most pessimistic research that this could occur within 30 years but almost certainly within 100 years.

The only good news is that the northern hemisphere is likely to take the brunt of global warming weather events.

hahahahahahahahahahahahahahahahahahahahahahahahahahahahahahahaha! I love this!!!!!

Exxon Mobil expansion. Over 12,000 jobs and there will be over 40,000 jobs in North Houston. Also, in today’s Houston Chronicle there is a front page article in the Business section about the new Exxon Mobil campus. There are currently 20 structures under construction !!!!!!!!!!!!!!!!!!! I have attached the link to Chronicle article with pictures.

http://blog.chron.com/primeproperty/2013/04/new-photos-show-progress-on-exxon-mobil-campus/

John-USA-CommercialRE

Email MeJohn here's a little tip for you. One off projects aren't much use to anyone. The Exxon project is what 2 years? Then what?

But lets put Exxons project in perspective. There are no new jobs. The project is a consolidation of several sites that are past there use by date and the importing of 2000 personal from Fairfax, Va. The new locale is simply a new beaut region that will siphon people away from older decaying locations. One wins while another looses.

Find something that gives us an idea of say a construction industry project pipeline for the next 5 years. How that would create/support a sustainable construction industry etc.

By the way you should also catch up with this

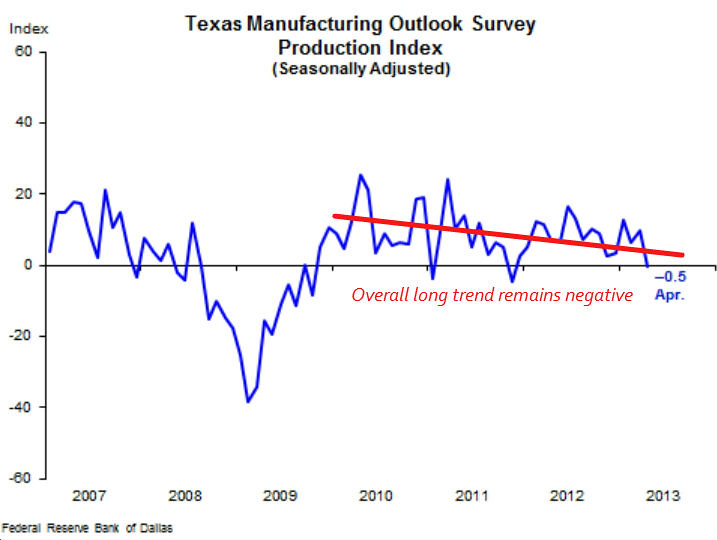

The Dallas Fed conducts the Texas Manufacturing Outlook Survey monthly to obtain a timely assessment of the state’s factory activity. Data were collected April 16–24, and 94 Texas manufacturers responded to the survey. Firms are asked whether output, employment, orders, prices and other indicators increased, decreased or remained unchanged over the previous month.

From the report:

Texas factory activity was flat in April, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, fell from 9.9 to -0.5. The near-zero reading indicates output was little changed from March levels.

Ebbing growth in manufacturing activity was reflected in other survey measures as well. The capacity utilization index came in at 2.7, down from 5.5, and the shipments index fell to zero after rising to 10.6 in March. The new orders index fell nearly 14 points to -4.9, posting its first negative reading this year.

Perceptions of broader business conditions worsened in April. The general business activity index plummeted from 7.4 to -15.6, reaching its lowest level since July 2012. The company outlook index turned negative as well, declining from 9.6 to -2.2. Labor market indicators remained mixed. The employment index has been in positive territory so far in 2013 and moved up to 6.3 in April. Twenty percent of firms reported hiring new workers compared with 14 percent reporting layoffs. The hours worked index pushed further negative, from -2.4 to -6.5.

Price pressures abated in April. The raw materials price index dropped from 19.1 to 2.5, posting its lowest reading since last July. The finished goods price index dipped to -3 after posting positive readings throughout the first quarter. The wages and benefits index edged down from 18.5 to 17.7, although the great majority of manufacturers continued to note no change in compensation costs. Looking ahead, 34 percent of respondents anticipate further increases in raw materials prices over the next six months, while 21 percent expect higher finished goods prices.

Expectations regarding future business conditions fell markedly in April. The index of future general business activity fell 22 points to -6.7, its first negative reading in five months. The index of future company outlook also plunged, dropping from 21.6 to 6. Indexes for future manufacturing activity fell slightly this month.

The Dallas FED's survey dovetails in with a lot of downside data coming in about the US economy as a whole.

I see ammo has doubled in price. That might be the most ominous stat of all.

Ammo Prices Have Doubled Since December At 'America's Largest Gun Shop

If I was to even consider Texas CRE this trend concerns me.

Texas growth appears to me as an MSM created illusion. Texas is a lifeboat for a failing US economy. The apparent growth obscures a failing internal manufacturing/commercial economy.

1031 buyers are under pressure to complete there transactions….and are not a good indicator of market conditions

i agree with freckle on the anchor tenant comments…. Cap rates on commercial follow the risk reward curve… Like here in Portland were I reside multi family trades at 5 to 7 caps but vacancies are less than 2 %. Get what you pay for

Dad cat bounce sounds like a stock. I like fibonnaci rules. The Florida market is always number one for foreign investors.

Anyways, I'd like to see Freckles numbers on large metros and malls. All I see when visiting major metros like L.A. are construction and building up since there is no more space to expand. Even in cities 40 miles out, the malls are expanding. I think it depends on the area where expansion (or gentrification) is occurring. Price per sq ft is going up everywhere I can see so I'd lean towards an improving economy and cost cutting by the major tenants closing down stores.

One thing I do know though is prices cannot continue to go up when interest rates start to rise which is imminent. If the FED believes in the gloom and doom, then we are in luck to fetch a property with low rates and better COC returns.

You must be logged in to reply to this topic. If you don't have an account, you can register here.