All Topics / Help Needed! / Change of plans

Hi brendon

Welcome and we are all here to help. One thing I learnt from this forum is that you will get both positive and negative opinions in terms of the property market. Who is right? Well no one really, some people will make allot of money and some people won't in these times. I'm only 5 years older then you and I sold two out of my three investments properties . Properties

has changed my life for ever, we are very comfortable finically. My family at the time said don't buy , it's bad to own properties but thank god I didn't listen to them. For me property does not interest me at the moment, but I invest in other things, I keep regular contact with this forum because I have met some really good people and the market is always changing so I need to ensure that my knowledge is kept up to date

Budget, learn about money, learn how to negotiate and learn to take rrisk team up with a good broker, Jamie or Richard ffrom here can help, get a good accountant and a lawyer

Also just because you live in Melbourne it does not mean you can invest in other states!!'

Jpcashflow | JP Financial Group

http://www.jpfinancialgroup.com.au

Email Me | Phone MeYour first port of call in finance :)

These forums are great because one way or another you will learn. And generally people are inspiring folks here because they have dared to entertain the possibility that just sitting carefully at a day job until you are 65 years old and not doing anything other than just pay off your own house… just might be a disastrous plan, so perhaps it is a good idea to investigate what other options there might be.

Hope you learn lots here!

Jacqui Middleton | Middleton Buyers Advocates

http://www.middletonbuyersadvocates.com.au

Email Me | Phone MeVIC Buyers' Agents for investors, home buyers & SMSFs.

Dwolfe wrote:Having said that I disagree with having 200k in ur hand in 5 years as inflation will mean that the money you have now will be worth less in 5 years than it is now.JacM wrote:Agreed DWolfe, $200k in 5 years from now will not buy what it can buy today. Let's say that today a chocolate bar costs one dollar. You can buy two hundred thousand of them today. Five years from now that chocolate bar will cost $1.50. As such your $200k will only buy 133,333 chocolate bars.Now ladies you know I'll have to put you over my knee if you start to talk drivel.

What they fail to tell you is that rather than confectioneries consumer goods have in the main depreciated not to mention your average property over the last few years. Statistically you have more chance of buying a property in todays market that will loose value rather than appreciate. If you do happen upon one that does appreciate it'll take on average at least 3 years just to recover your entry costs not to mention hold costs and heaven forbid you have to sell and cop exit costs.

What they also fail to mention is that term deposits are on average twice that of inflation. So given that over 5 years you're likely to see a wage increase or two hence save more and that while inflation is currently below 2% and term rates closer 4.7% my educated guess is that the odds on you having more in your pocket by holding and continuing your current path will be far more productive than burning up the property market with misplaced enthusiasm.

Oh and did I mention. Warren Buffet, one of the most successful investors in recent times key principle… the power of compound interest.

Stick to what you're doing, bide your time and keep on learning. The market is on the way down. You can make more not buying currently. There's going to be lots of opportunity in the next few years to nail cheap property if that's still your thing.

The Freckle

I do not agree with you. I believe most of the evidence shows that most markets across Australia have now bottomed. The great thing about being an investor is that you are not tied into any local market. As an example I believe that the Brisbane market is currently undervalued and there are still great opportunities for capital growth. However you need to do your own research. With Brisbane I especially think its worth buying property within 5 km of the CBD

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

Nigel Kibel wrote:The FreckleI do not agree with you. I believe most of the evidence shows that most markets across Australia have now bottomed. The great thing about being an investor is that you are not tied into any local market. As an example I believe that the Brisbane market is currently undervalued and there are still great opportunities for capital growth. However you need to do your own research. With Brisbane I especially think its worth buying property within 5 km of the CBD

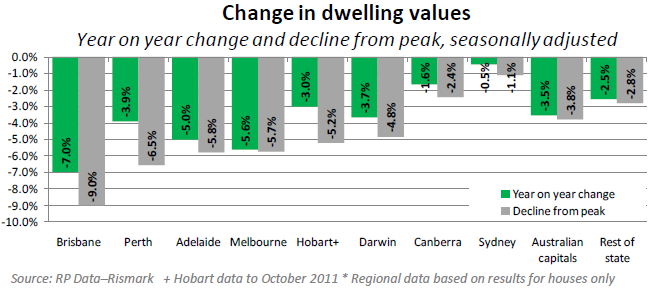

Aagh yes the old bottomed theory. Trouble is the trend doesn't agree with you. Maybe you think Brisy has bottomed because its been copping a flogging.

RP Data-Rismark December Hedonic Daily Home Value Index Results

National Media Release

Capital city home values fall over consecutive years, down -3.8%

in 2011 and -0.4% in 2012

Down 3.8% in 2011 and 0.4% in 2012, does that mean the downward trend is slowing?

If you look at the graph here instead of the media release it shows it in a bit more detail, with units included not just for houses so you get the bigger picture;

So you would like to do a development, yet you acknowledge that it requires more cash then your current available equity. But then you go talking about putting your deposit down and getting cashflow from the property.

How about asking yourself what do you really want? Do you want a lump sum cashprofit or do want to have cashflow.

You could put all your deposit on one house and you could do a renovation on it and achieve a small cashflow outcome at the end of it. Or you could look to target a property that would make you a lump sum profit.

Easy question to ask yourself. In 1 years time would you rather turn that 50k into 100k? Or would you rather have 5k cashflow. Ie positive cashflow of 100 bucks a week. That's assuming you put all your money onto one property, most likely did some improvements to the property and picked a area with relatively high rental yields (could be regional) . I for one would be focusing on building my equity base up so that you have the cash to buy the opportunities that come up. Which means looking for properties which would make a decent cash profit after sales. You could look at flips, buy renovate and sell, getting the DA on a land division and on selling. These strategies will require you to know your area/location of property inside out so when something comes up you can act with speed and the confidence that after looking at sold prices in the area for the last 6 months etc you know your getting a good deal.

Here's a different idea. Don't have enought cash to do a development. Go borrow the money to do it. If you want to be aggressive or think that's your nature.

Lets be honest if you found a subdivision that you could do and just selling off the land would make you a hypothetical profit of 50k after all your costs. But you needed your 50k deposit to secure the property at 95 percent with LMI up to 97% and you had no money left to pay for the subdivision costs and mortgage for 12-18 months. Would you turn that deal down ? Why wouldn't you just go take a personal loan for the interest required/sub d costs required. If you couldn't pay the interest costs on the personal loan why not borrow a bit more to pay for that.

If you borrowed a hypothetical 50k on a personal loan fully drawn at 15 percent, that's 7.5k interest for a year.

Your still making a profit after costs and interest on the personal loan of 42.5k.

So what would you do? Some might say that's risky and you should save up the costs for the subdivision.

But in 2 years after you've saved up that money. How many opportunities would you have missed. Food for thought mate

Wilko

Gazza21 wrote:Down 3.8% in 2011 and 0.4% in 2012, does that mean the downward trend is slowing?Who knows Gazza. Nigel may be right but picking bottoms is notoriously difficult. I could buy his theory if their were some sound macro economic fundamentals to support his proposition but virtually everywhere you look you see economic contraction if not now then on the not too distant horizon.

Virtually every driver that underpins the property market is absent or weak and no change in site. Any positive sentiment out there is simply a reflection of hope. Not a good metric for investing.

wilko1 wrote:So what would you do? Some might say that's risky and you should save up the costs for the subdivision.

But in 2 years after you've saved up that money. How many opportunities would you have missed. Food for thought mate

Wilko

I often think that when I walk past the Lotto store. But then I say to myself well there's 100% chance I'll still have my $50 if I do nothing, a 0.000002222222222222222% chance I'll win the big one and if I buy and don't win a 99.99999777777778% chance I'll have zip.

Well to maximize his chances of winning the big one freckle he should put $50,000 on the lottery and then he's just increased his chances of winning by 1000

wilko1 wrote:Well to maximize his chances of winning the big one freckle he should put $50,000 on the lottery and then he's just increased his chances of winning by 1000

wilko1 wrote:Well to maximize his chances of winning the big one freckle he should put $50,000 on the lottery and then he's just increased his chances of winning by 1000

That's improved the odds to 0.1111111111111111% Boy now you're talking!

That is ingenious wilko1, are the odds really 0.1% at $50k?

I've just had a lightbulb moment. If I get the $50k personal loan and put $100k down that would raise me to 0.2%?

Thanks Steve for creating this forum!

Perhaps you could create a syndication with advertising of "potential return of 70 million dollars, only $50,000 investment" get 10 members and now you have grand total of 1 percent to win. I can see the people running to the phones now

In all seriousness, wilko1 thank you for that post it was probably the first one that has actually made me think of a few different options. The way you put it made me see it easier with the $100 positive per week or work on creating more equity. I personally want to get the best of both worlds ie get a property with development/subdivision potential that could be realized in the short term future. The only issue with that is I can't look in the rural areas I've been looking at currently and maybe shift my search to outer Melbourne suburbs instead. The higher yields aren't there but the development potential is, land doesn't sell at a decent enough price in the rural areas and the costs of doing a development in rural areas may not stack up to make a good enough profit to justify the headaches.

So maybe I have to narrow down my search to the outer Melbourne suburbs which will have development potential, although lacking the higher yields your right I have to focus on building equity so early in my journey. I have a fairly decent deposit and if I look at purchasing in areas like Melton or Werribee I will still be able to find good enough yields to cope and it will be much easier for me to do any works to because it is more local for me.

This was always a very strong path for me to go down but I was in two different minds as to what I wanted to do. In the mean time I think I'll just research and see what I can look at doing which will be the most beneficial for me.

brendogs wrote:In all seriousness, wilko1 thank you for that post it was probably the first one that has actually made me think of a few different options.One of the great challenges when you start out is not only the many and varied options you can develop but what is most often lacking is how to evaluate risk and match appropriate risk to market conditions. Wilco's proposal is a legitimate play but it is a high risk play and one you reserve for hot markets.

Melbourne and Victoria in general is a cold market so you need to develop more conservative strategies to play and survive in that market. Markets like Victoria probably offer the most difficulty for newbies simply because they don't know how to mark risk to the market realistically.

As a new kid on the block you want to reduce risk where possible. For example the Sydney market offers far less risk than the Melbourne market. Start slow while you work the kinks out and progress up the learning curve.

Point to Freckle.

Hunter Valley is looking good, low buy in price, ability to add value later through reno or development. And good current cash flow. WA has bottomed and should head back up now so might be some opportunities there. hat to some locals about the changes in infill requirments, iit's looking good.

Melton still has a lot of new Housing going in, high vacancy rates, also has one of the worst literacy levels in the state…

Plenty of other options if you at looking to do cf+ with profit in a few years, gotta

do homework.

Please excuse eerrors typing on phone, no Internet ATM

Cheers

D

DWolfe | www.homestagers.com.au

http://www.homestagers.com.au

Email MeYou can have the best of both worlds brendogs. Im gonna say its a pretty easy solution just develop property for positive cashflow. Buy a house, build a couple more houses to go with that house on the block, sell a couple keep 1, positive cashflow. Life shouldn't have to be hard. But to get to that stage, you need some money!

You must be logged in to reply to this topic. If you don't have an account, you can register here.