All Topics / Overseas Deals / Japan.. is collapse inevitable?

Ziv Magen plays in this neck of the woods and is an enthusiastic supporter of the region. As someone who runs a business dependent on the economic health of the region and a Japanese property investor himself it would be a given that any comment would have substantial bias built in.

Ziv and I have opposing view points on Japans economic outlook so I thought I'd offer a completely neutral (as neutral as one can be anyway) overview of the predicament Japan now finds itself in via a presentation given by Kyle Bass in late 2012

To wit..

and to emphasis the points made by Kyle Bass above..

Japan isn't just facing macro troubles. Its micro competitiveness is rotting

away. It is just bizarre to see that the whole world believes in a strong yen

when Japan is failing on such a grand scale.

And for those who think this is crystal ball gazing I'll just say this… You don't need a crystal ball to tell you that when your car runs out of fuel it'll stop.

Hi Freckle,

I am not going to have time to look at this video at work, but here is a quick opinion about Japan, My view is based from two people (one is my mentor) who own one of the largest logistics company in japan and who sit on a board of a certain car manufactures and owns a Japanese real estate firm

I actually spoke my mentor only two weeks ago, he regularly flies in and out of japan. Our meeting started about "the logistics business in japan" This business has been operating for over 20 years and he has key clients who i cant name, but from his view the amount of freight leaving the country is diminishing at a quick rate. He showed me some figures (in regards to the amount of containers moved over the last 5 years) and you could see how much the market has slowed down.

My mentor admitted that the economy is in trouble in Japan and he has had to slash a high number of employees hours from Full time to Part time, Thankfully being such a large company he gets great support from the Japanese government.

But he made a good point, Should fear stop him? Nope he is always looking at ways at improving his bussiness and on the other hand his real estate bussiness remains pretty steady.

Jpcashflow | JP Financial Group

http://www.jpfinancialgroup.com.au

Email Me | Phone MeYour first port of call in finance :)

Doesn’t seem like a rosy future ahead.

My FIL has a small engineering shop in outer Tokyo but is almost being forced to retire due to lack work coming in.

At the moment they are buying other currencies as their accountant has warned of a massive devaluation of the Yen to be coming soon.

My worry is that so many people believe that the government will be able to provide for them in retirement as they have paid the super tax during their working lives, but it just doesn’t seem sustainable with an ageing population and massive government debt.

Jpcashflow wrote:My mentor admitted that the economy is in trouble in Japan and he has had to slash a high number of employees hours from Full time to Part time, Thankfully being such a large company he gets great support from the Japanese government.

But he made a good point, Should fear stop him? Nope he is always looking at ways at improving his business and on the other hand his real estate business remains pretty steady.

Couple of points Jo.

- The primary focus of the thread is; how do foreigners with Japanese assets play this market through this particular time frame? Your mentors situation is interesting and certainly reinforces the deteriorating situation in Japan from an insiders viewpoint but he won't be exposed to FX risk.

- Should fear stop him? In real terms he has little choice but to continue to manage the situation. Fear shouldn't be allowed to play a part in one's decision making. The objective should always be to take an honest and open appraisal of any situation whether it be improving or deteriorating and make plans accordingly.

There are 2 major concerns with investing in Japanese RE namely;

- deteriorating economics which eventually begin to tell on property values if it isn't already and,

- a public policy of substantially devaluing the Yen.

This new govt headed by Abe was a disaster last time and given their nationalistic leanings I have little doubt things will flow along the same lines as the last debacle especially where China is concerned.

Commentators see Japan as "a bug looking for a windscreen" and "a slow motion train wreck". Can't argue with either of those assessments.

A couple of graphs to enlighten the readers:

The problem with the following graphic is not that Jpn is top of the pops but that the rate of debt accumulation by other economies has jammed those countries into a corner meaning their ability to support global growth and assist Japan to somehow survive a little longer is fast running out of steam. The reality is that if you have a huge debt load serviced by an export led economy then you absolutely need a healthy global economy to support you. That's no longer the case.

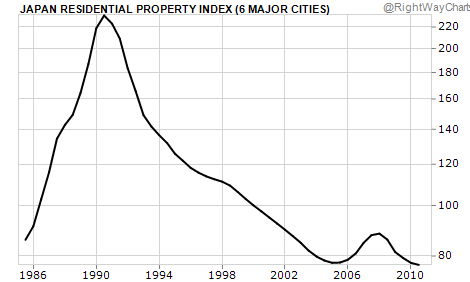

… and as things continue to go south the ability of punters to buy into the property market has taken somewhat of a battering over the years.

Given that property is usually considered a long term play I can't for the life of me see how the Japanese RE market could be considered a sound investment. I have problems even considering it viable as a speculators market

Very interesting thread – I had 2 Japanese investors purchasing here and both mentioned that they 'escaped' Japan as they believe the economy is terrible and they have no confidence and things are going to get any better anytime soon. No real concrete evidence or numbers but just the word from the people living in the country.

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

I wouldn't write off Japan.

They can always just print money.

They can pay people to breed. Or finally let some immigrants in.

The sales tax can work.

Third biggest economy in the world – unlikely to just collapse…

alfrescodining wrote:I wouldn't write off Japan.They can always just print money.

Have for 20 years… next suggestion.

Quote:They can pay people to breed. Or finally let some immigrants in.Explain to me again how that helps an export led economy with declining export markets

Quote:The sales tax can work...and what do you think the rate should be? Keep in mind that at 1000% they still can't raise enough to solve their debt problems.

Quote:Third biggest economy in the world – unlikely to just collapse…Aagh yes.. the Too Big To Fail theory

Freckle wrote:alfrescodining wrote:I wouldn't write off Japan.They can always just print money.

Have for 20 years… next suggestion.

Quote:They can pay people to breed. Or finally let some immigrants in.Explain to me again how that helps an export led economy with declining export markets

Quote:The sales tax can work...and what do you think the rate should be? Keep in mind that at 1000% they still can't raise enough to solve their debt problems.

Quote:Third biggest economy in the world – unlikely to just collapse…Aagh yes.. the Too Big To Fail theory

So what are you saying by "collapse"? The country will cease to exist? Anarchy in the streets? Sure a relative decline is probable, but a collapse will not happen.

Japan has NOT been printing enough money. There's definitely scope to be more aggressive in this regard, just like America has or even more so. Increasing the money supply depreciates the Yen so exports benefit.

Anyway, if you say a "collapse" is inevitable, then the Yen would also "collapse". The economy can't "collapse" without the currency following, so the economy would be partially sheltered from any major downturn by an increase in export competitiveness.

They have huge foreign currency reserves and huge foreign bond holdings. Most of their debt is held locally. They can raise the pension age or abolish the pension altogether if they really get desperate.

Soooooo many reasons why Japan will not just "collapse".

In your favorite style and spirit of linking to graphs, articles and presentations that support your theories, here are a few of our own, that we've been collating for new and existing clients over the past year –

http://www.nippontradings.com/japan-real-estate/busting-japans-impending-debt-crisis-myth/ ("business insider")

http://www.nippontradings.com/japan-real-estate/japans-miraculous-economy/ ("mindful money")

http://www.nippontradings.com/japan-real-estate/japan-economy-set-to-soar/ ("Reuters")

there are more, of course, but the main point is, as others have pointed out above, that Japan has quite a few other ways of dealing with the current state of affairs – and the "hasn't made a difference for the last two decades" is really a double-edged sword – according to this rationale, Japan should have dived nose-first into currency collapse and become India or myanmar a decade or two ago, rather than go into a mild recession and come out of it as resilient as ever – yet somehow, miraculously, they're quite far from it.

yes, I'm biased, in the sense that I'm a firm believer in the Japanese people and their resiliency, creativity and hard-working, sincere mentality, and believe that they'll find a way to persevere (even without adopting IMF policies, imagine that). What this actually is, i love to read assumptions about, but leave to wiser folk than myself (the links above point to a few options, as have the comments on this thread). as for me, I deal in real-estate, and advise my clients to always be positioned with ample reserves and minimal leverage, so that they're able to take advantage of current conditions, and not play with money they'll need back in a hurry (unpopular concept for property investments, I know, considering so many folk out there try to liquidate all their belongings at the first sign of price drops and lose their pants in the process, or leverage themselves to kingdom come and lose everything when the **** hits the fan). Incidentally, this happens in any country at some point in time over every decade or two – I'd rather be in Japan when this happens than any other place in the world, any day of the week. They know how to deal with crisis without resorting to doomsday and Armageddon scenarios far better than us whiners and selfish "save yourself, screw all others" in the west

As a side note, I hardly believe that someone who, according to their own testimony firmly believes in hoarding precious metals and their related stocks and industry assets (which someone less polite might label "dealing in fear and paranoia") has any interest in making any other investment seem attractive, and would most likely do their best to continuously convince anyone who'll listen that "the worst is yet to come, beware the impending global meltdown, it's only just begun", etc etc. but we already had the pessimistic vs optimistic vs realist discussion, maybe we can save ourselves the trouble this time, since we're both not likely to change our tune in this regard.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

"Soooooo many reasons why Japan will not just "collapse".

And I, like many I'm sure, are interested in hearing what they are.

I have a lot of Japanese (and other nationalities that happen to have worsening economies) investors purchasing in high end areas of Sydney. Does that have anything to do with the state of Japan? Not sure but a lot of them are saying we want to be earning aussie dollar (they may be referring to dollar's strength, stability or both)?

Regards

Shahin

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

zmagen wrote:In your favorite style and spirit of linking to graphs, articles and presentations that support your theories, here are a few of our own, that we've been collating for new and existing clients over the past year –http://www.nippontradings.com/japan-real-estate/busting-japans-impending-debt-crisis-myth/ ("business insider")

http://www.nippontradings.com/japan-real-estate/japans-miraculous-economy/ ("mindful money")

http://www.nippontradings.com/japan-real-estate/japan-economy-set-to-soar/ ("Reuters")

Interesting articles from the point of view they almost always ignore the elephant in the room.

You have a debt problem. Up until now you've been able to fund that debt to maintain the country with savings (and ZIRP) and the ability to maintain an export surplus. The export surplus has gone as trading partners around the world grapple with their own debt problems after 30 years of a credit fueled spending spree. The cheap money is or has come to an end. The next generation of borrowing (to fuel a system that requires 40% of it's budget go to just servicing cheap debt) will be considerably more expensive than in the past.

The immediate challenges facing Japan are how does it cope with an export and subsequent income decline, remediate the Fukushima and associated nuclear power problems, maintain the status quo in a declining/aging population as pension demand accelerates and deal with a mounting debt problem that threatens to swamp them.

Quote:there are more, of course, but the main point is, as others have pointed out above, that Japan has quite a few other ways of dealing with the current state of affairsGreat! What are they because as Kyle Bass points out quite clearly the discussions he's had with the leaders of Japanese financial institutions have all but admitted they have no idea how to solve this problem. They're out of bullets

Quote:– and the "hasn't made a difference for the last two decades" is really a double-edged sword – according to this rationale, Japan should have dived nose-first into currency collapse and become India or myanmar a decade or two ago, rather than go into a mild recession and come out of it as resilient as ever – yet somehow, miraculously, they're quite far from it.Enron looked great just before it collapsed

Quote:yes, I'm biased, in the sense that I'm a firm believer in the Japanese people and their resiliency, creativity and hard-working, sincere mentality, and believe that they'll find a way to persevere (even without adopting IMF policies, imagine that).Societies almost always do, however, many experience considerable pain and dislocation during this coping period.

Quote:What this actually is, i love to read assumptions about, but leave to wiser folk than myself (the links above point to a few options, as have the comments on this thread).The links above do not point to options or solutions that haven't been tried before a hundred times with no affect. In fact most of the so called solutions involve fudging the figures and CB balance sheet expansion. In every case the situation has deteriorated a degree further.

So here's a challenge for you Ziv. Find the readers an example of Japanese government and or BOJ intervention that has or will turn this impending debt crises around.

Quote:as for me, I deal in real-estate, and advise my clients to always be positioned with ample reserves and minimal leverage, so that they're able to take advantage of current conditions, and not play with money they'll need back in a hurry (unpopular concept for property investments, I know, considering so many folk out there try to liquidate all their belongings at the first sign of price drops and lose their pants in the process, or leverage themselves to kingdom come and lose everything when the **** hits the fan). Incidentally, this happens in any country at some point in time over every decade or two – I'd rather be in Japan when this happens than any other place in the world, any day of the week. They know how to deal with crisis without resorting to doomsday and Armageddon scenarios far better than us whiners and selfish "save yourself, screw all others" in the west

Sound advice and the last place I'd want to be on earth if things go south is the US or Europe.

Quote:As a side note, I hardly believe that someone who, according to their own testimony firmly believes in hoarding precious metals and their related stocks and industry assets (which someone less polite might label "dealing in fear and paranoia") has any interest in making any other investment seem attractive, and would most likely do their best to continuously convince anyone who'll listen that "the worst is yet to come, beware the impending global meltdown, it's only just begun", etc etc.Ziv it's standard strategy in Investing 101 – hedge your bets. There isn't a market that isn't rising and falling like a yo yo anywhere that I'm aware of. It has to be one of the craziest and least predictable times to be an investor in anything. That in itself tells a story.

Quote:but we already had the pessimistic vs optimistic vs realist discussion, maybe we can save ourselves the trouble this time, since we're both not likely to change our tune in this regard.It's no fun debating with someone who agrees with you. Where would I be with out you.

TheFinanceShop wrote:I have a lot of Japanese (and other nationalities that happen to have worsening economies) investors purchasing in high end areas of Sydney. Does that have anything to do with the state of Japan? Not sure but a lot of them are saying we want to be earning aussie dollar (they may be referring to dollar's strength, stability or both)?Regards

Shahin

And that presents a few problems for us here. If the AU$ continues to garner support as a safe haven currency then that is likely to attract more capital seeking refuge than is good for us. The RBA's attempts to lessen that attractiveness may well backfire on them if RE is perceived to be cheap and a safe store of value. Make interest rates cheap attracts more RE money creates bubble creates bust conditions etc etc.

I expect to see more RBA and government intervention in this area. Neither of which will be able to deal with the currency appreciation problem effectively. Iron Ore is breaking $150 so watch out for a strengthening dollar if that price holds for a while. We might even see a budget surplus if ore holds but that puts future rate cuts into question.

There are warning signs that ore could collapse though. Prices appear to be driven by budgetary expectations in China. The spread between the spot and 12m swap price is as wide as its ever been and that usually indicates a price correction is likely.

As a side note it's estimated that the unit market in Sydney is fueled by $2B and Melbourne $1B of Chinese capital.

A possible solution to Japan's problems by Jared Diamond, a professor of geography at the University of California, Los Angeles

Three Reasons Japan’s Economic Pain Is Getting Worse

Diamond alludes to the problems causing their current predicament and potential solutions, however, I think things would have to get much worse before the Japanese government acted along these lines particularly immigration. Japanese are one of the most xenophobic cultures out there so I have no idea how you would get that initiative across the line in a way acceptable to their wider community.

PS: this bloggers personal testimony questions Japans ability to support immigration as part of an overall economic recovery strategy. I found his story quite reveling regarding Japanese culture.

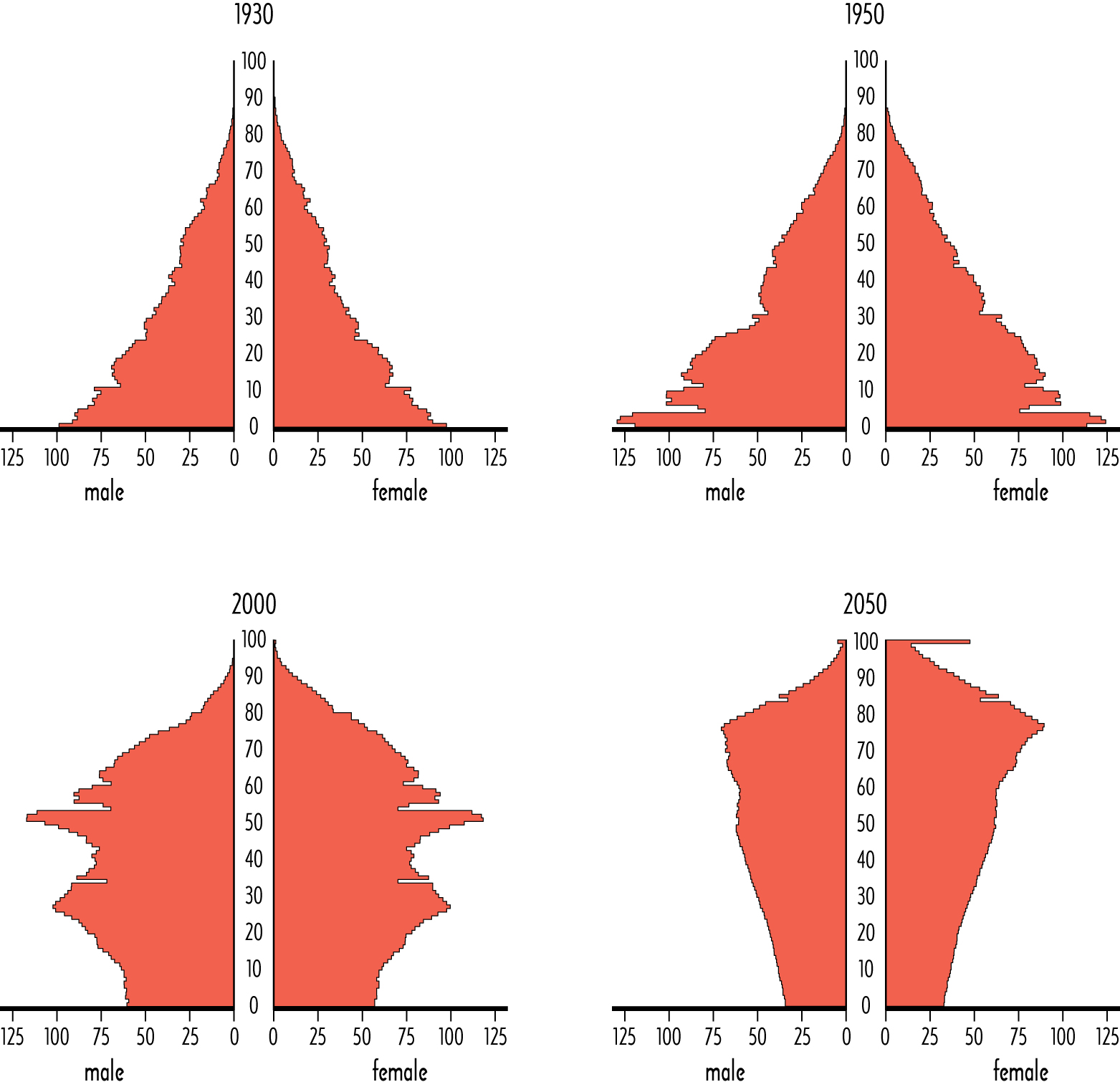

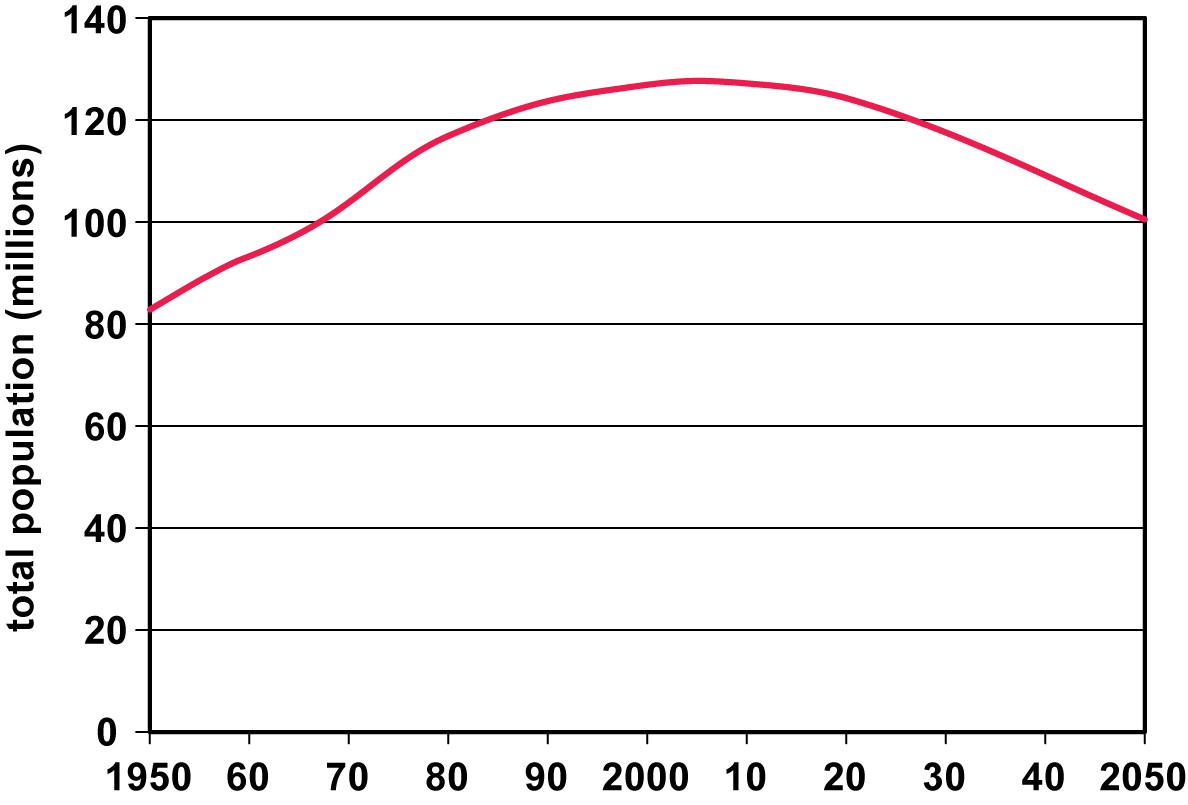

Ignoring Japans immediate financial problems for the moment one has to wonder where the RE market will get its demand from given two significant population issues are deteriorating at an accelerating rate namely a declining population coupled with an aging population.

Interestingly, all of the these investors have specifically purchased units and I would say 9 out of 10 have been off the plan.

TheFinanceShop | Elite Property Finance

http://www.elitepropertyfinance.com

Email Me | Phone MeResidential and Commercial Brokerage

The above graphs throw up another interesting aspect of interest. How does this affect debt/wealth on a per capita basis. in other words what will be the populations ability to spend be going forward.

The following graphic suggests individual spending power could be overcome by huge debt loads.

This doesn't imply that massive amounts of debt will be taken on but that the population base servicing current debt loads will decrease significantly. This adds weight to the argument that the Japanese tax payer will face crushing debt servicing loads unless the Japanese government can find a way to restructure its debt liabilities.

This illustrates why simply increasing sales tax rates will not work. They're going to have find other ways to increase revenue from an ever declining tax payer base which suggests increasing taxes on tax payers will be self defeating. Taxing businesses is also a no win situation as Japans competitiveness continues to decline. The BOJ's attempts at currencie devaluation to help exports is generating unintended consequences such as capital flight.

All that kinda puts the next graphic into perspective.

The income to expenditure gap just keeps getting wider. I wonder how far you can stretch a rubber band before it snaps?

Freckle wrote:Interesting articles from the point of view they almost always ignore the elephant in the room…example of Japanese government and or BOJ intervention that has or will turn this impending debt crises around…

I don't agree that these articles ignore the problem, on the contrary – I find that they address these problems squarely, and claim that, for one thing, its blown out of proportion, and that releasing central bank deflationary policy for example, in order to "let the market take its natural course", to name one existing policy suggestion that some think may help, isn't exactly the magical cure that the IMF and various central governments around the world hail it to be. Or, in other words, yes, Japan's government has borrowed extensively from its citizens (and will probably do more of the same for as long as global economy remains in the doldrums) – but so what? Or to quote "mindful money" – "…yields can go higher when domestic investors are unable to fund budget deficit fully – but it is highly doubtful that such a scenario would become a debt crisis. It’s far more likely that the Japanese Yen will depreciate strongly for a while – as it has done in the past – without any major implications for the economy as a whole long-term – only to rise again when appropriate corrections or global market forces allow it to…"

not that Japan should sit and wait for these conditions to occur – on the contrary, it should do all in its power to support this scenario – and it plans to. The same links also claim that yen depreciation, for instance, is exactly what's needed now to re-ignite export (something that Australia, for all its merits, hasn't worked out yet, btw), with which I completely agree. Incidentally, Abe, recently re-elected, while not my favorite PM in the world, is what, in my opinion and that of various media outlets worldwide, kicked off that current depreciation (coupled with some attractive stock market hikes) – his doctrine of dropping the nationalistic approach his party has adopted in the past, in order to re-strengthen ties with China severely hurt over the islands fiasco, kick off more public works to strengthen disaster preparedness and stimulate the economy further, (quite different to "printing money till the cows come home", which you wrongly suggest japan has been doing), offer the worlds most attractive renewable energy tariffs, in order to make Japan the world's leader in renewable energy (http://www.nippontradings.com/japan-real-estate/japan-emerging-as-worlds-new-renewable-energy-leader/), which has already began to draw substantial foreign investment into the country as well (Spain's "Gestamp Solar" has just announced a $1.5 bil project in northern japan, and i believe they're only the first of many, now that al of Japan's tech giants are so heavily invested in solar and wind power), extend retirement age to lower the pressure on pension funds and allow them to slightly recuperate, while at the same time raising taxes (I was greatly relieved to hear Abe's maintaining the DPJ's policy of gradually re-introducing goods and services taxes, increasing property taxes back to their original values, etc) – all of the above are a great combination of means to those ends.

the approach you try to perpetrate, as if there is a singular "magic wand" that someone can wave to make things better, and Japan just hasn't found one yet,or has tried all magic wands to find that they don't work, is a very black and white oriented view of economy – just as Japan's borrowing from its pension funds isn't the only reason it got to this state (and I still don't buy the doctrine that claims public debt is the only measure of an impending financial crisis, that's also an very narrow and extreme view of the world in my opinion), there isn't one particular solution that'll fix the problem. There has to be a collective of measures, trials and errors, that react to internal and external conditions and are fine tuned over time – which is exactly what the administration is trying to pull off (hopefully with a bit more of a parliamentary majority, to actually be able to move stuff forward this time around).

Freckle wrote:…maintain the status quo in a declining/aging population as pension demand accelerates..You say you don't believe xenophobic Japan will allow more immigration – fortunately you're plain wrong. Immigration laws have already gone through one major overhaul, and there's another in the pipes, the amount of foreigners one sees in the streets of not only Tokyo, but far away cities like Fukui and Fukuoka is growing by the day (and I'm not referring to Chinese and Koreans either), and even the US ambassador, recently interviewed in Tokyo, is expressing amazement at the amount of entrepreneurship and cross-cultural initiatives that have been taking pace in the country recently (http://www.nippontradings.com/japan-real-estate/japan-opens-up-to-foreigners/ – http://www.mercurynews.com/breaking-news/ci_21708023/q-us-ambassador-japan-john-roos-entreprenurial-culture). And I'm sure you realize people migrating to Japan aren't doing it for the marvelous social benefits, like so many of them do in Australia, for instance – they work, hard, build families and stimulate not only the economy, but the country's industries and, most significantly, its non-procreating society in many magnificent ways.

Turning challenge to opportunity, another thing Japan is extremely good at, also means that the robotics industry, boosted here tremendously in recent years due to the tough requirements placed on the country's resources by the ageing population, is also becoming a huge export (and again, yen depreciation is only helping in that regard when it occurs). So are smart and electric cars. There are just so many bullets Japan still has in its arsenal, and only a minority of them have anything to do with government intervention and BOJ policies, that your attempt at portraying the end of the world as we know it in this regard is just ludicrous in my view.Ccertainly, Japan has its issues, xenophobia and public debt being just two of the bigger ones among them – but the apocalypse you're predicting is only one of a myriad of scenarios that can play out here – and not a very likely one in my opinion.

And again, as mentioned (at least we agree on that much) – there's really nowhere else I'd rather be active and invested in at this global day and age. The alternatives, from a financial, personal and social perspective, are far worse in my view when things go downhill. but again, I'm biased – I love this place with all my heart, and have huge faith in it.

yes, hedging is investing 101 basics (and believe me, I do, although not in gold and silver, my heart's a bit too faint for that one, I prefer something far less volatile and liquid, such as real estate in other countries or plain ol' cash deposits bearing reasonable interest, and easily accessible for exchange rate fluctuation action when its profitable, but to each his own)- but so is the long-term view. Real estate investment at its best (as opposed to wild speculation and gambling) is a long term endeavor. A year or three of price drops or currency depreciation is nothing to fear – thinking that it won't happen is preposterous, and a sure recipe for disaster. Sure, the yen may depreciate for a year or two (although there are still enough ups and downs in those periods to make some nice profits or quickly bring income home, too) – but the huge advantage in Japan is the cashflow. When you're making 10-15% p/a pre-tax in yen, with money that you're in no hurry to liquidate, and on investments that, to begin with, are at $20-50k a piece (which means you can spread them out over 10 properties to the typical Australian 1-2, for instance), you really have very little to lose – even if the yen depreciates for a decade (which I very much doubt it will).

if, on the other hand, you're investing for your day to day income, and your family starves if you can't withdraw your rental income on a monthly basis, with no reserves, alternative sources of income and/or exit strategies, you're in the pits – but I honestly don't think this has anything to do with which country you're invested in, and everything to do with being plain stupid. I try to belong to the first school of thought, and strongly advise my clients to do the same.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

Incidentally, here are a few of the things the Japanese people, as opposed to government and BOJ, will most likely do, as they have in the past, if and when things go bad – taken from the comments to one of these types of apocalyptic forecasts published on the "Japan Times" (in English, by a foreigner, but rings quite true)-

"…Initially, the Japanese will cut back on stupid purchases like designer bags, couture, cupcakes for their pets, pachinko, and idol CDs.

Idle farmland will be put back into use and with proper management, the country will become self-sufficient in food. Imports of useless things like sugar and coffee will cease and the publics health will improve.

Barely anything will be wasted. PET bottles and plastic bags and anything watertight will become essential and reused over and over again. Clothes will not be thrown away unless unwearable (no – corduroy is not unwearable, just not cool)

Japans main cities have an advantage due the ease of cycling and network of highways. Even if trucks are not available, goods will still be shipped by bicycle, just slower and essentials only.

The depreciated Yen will be mostly disregarded and a "LETS" based system will support local areas who are skilled and have resources but little money. Japan has a very skilled workforce and well-established institutions. Just because the economy is bad, it doesnt mean these important factors will be lost.

Japans centralised and stupid government will become irrelevant and local areas will become self-governing and will no longer rely on "gasoline-less police." Rather, local volunteer militias will be formed to protect the surrounds as well as Japans national treasures.

Women will play important roles in the local economy by becoming the backbone of local manufacturing. The loss of public service jobs (women will be the first to be sacked, this is Japan) and will pool their talents, time and knowledge to produce clothes, furnishings, metal goods, gardens, candles, soaps and crockery.

The military will be reduced by the central government but martial law will be impossible due to the sheer numbers of Japanese people. The militaries of China and North Korea will have no inclination to attack Japan for the same reason and because their own situation will be just as perilous.

The Japanese will never allow themselves to become Somalia. The pride of this nation has brought it to where it is today and it would be like saying that one day Donald Trump would be on the street living under a bag. Too much knowledge and too much honour…"

just a few more of the "bullets" in the Japanese arsenal for bad times, if and when they hit – there ARE alternatives to the "mad max" scenarios.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

In regards to blogs about social issues, racism, xenophobia etc – I have sooooo much to say about this guy's observations and opinions and his understanding of Japanese mentality and culture – but I hardly think this is the forum to raise these issues. Suffice it to say that to take this guy's opinion and experience, as unpleasant as they sound, as an indication of what Japan is like for foreigners as a whole and why raising immigration as an economic solution has no future is clutching at straws.

Lets not get into this argument, please, as its endless and completely subjective. I can show you a gazillion blogs by foreigners in Japan who experience QUITE different sentiments, as well as a gazillion ones similar to this. It has no bearing on this discussion, and serves very little – it's certainly not as "revealing" as you may think, quite the contrary. I've also lived in Japan and sent my child to public education institutions here – my experience is substantially different to his, lets leave it at that for now.

Ziv Nakajima-Magen | Nippon Tradings International (NTI)

http://www.nippontradings.com

Email Me | Phone MeZiv Nakajima-Magen - Partner & Executive Manager, Asia-Pacific @ NTI - Japan Real-Estate Investment Property

You must be logged in to reply to this topic. If you don't have an account, you can register here.