All Topics / General Property / Lowest Vacancy Rate in the State – Sunshine Coast

Hi all,

This is my first post, though I have been avidly logging on and reading for the last year. Fantastic stuff – better than any property mag off the shelf.

Anyway, it's been a long time since anyone posted about the good old Sunny Coast and I thought it might be interesting to hear everyone's thoughts. I surprisingly read today it now has the lowest vacancy rate in the state, at 1.3%. Living and having invested here about a year ago when there was little to be excited about, things certainly seem to be heating up. The employment sector has grown considerably, with lots of commercial construction going on, and heaps more in the pipeline. The housing market seems to be moving, albeit slowly. Tourism is back on the rise, while new housing supply is poor.

We are getting a ROI of 6.8% currently, with deals like this not uncommon. I follow the market closely and heavy discounting is still occurring regularly – mainly due to people's expectations being too high in a market that hasn't hit its straps yet.

So my question… Is the area that Kochy once slammed as a dud ready to relive its golden years?

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

Having just moved up here from Brisbane i can voice my opinion for the volume of housing here. Took us six weeks to get something and around 15 applications where we were often 1 out of 10 people viewing. Getting very tight up here!!

Its an interesting scenario at present..

Vacancy rates have had a lot of volatility in the last 6 months, but a trend seems to be developing in the downward direction. Net migration onto the coast has actually declined compared to historical standards, but that too seems to be reversing as well. Vacancy rates were at 2.3% this time last year.

Speaking to local agents I have been told of the heavy increase in applications from people moving down from Gladstone (Vacancy Rate – 5.8% currently) and other mining towns. As the work available is declining, people are seeking more desirable locations to live and taking advantage of the FIFO revolution.

Lets see if Clive can deliver his promise of the new airport extension. An increase in flight pathways to the Sunny Coast from Australia wide is urgently needed to support this growing sector.

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

All of my investment properties are in Brisbane with one on the Gold Coast and i must admit the vacancy level is nil and has been for the last 6 months.

Even when one or two of the units have become vacant due to their inner city location we have had a dozen applications for each unit.

Certainly at the moment every 6 months you can look to increase the rent.

Cheers

Yours in Finance

Richard Taylor | Australia's leading private lender

Thanks for your comment Richard.

It's certainly interesting to see the same trends flowing into Brissy. There was a lot of talk of excess construction of inner city apartments in Brisbane, though it seems to be meeting demand nicely.

I'm interested to know your thoughts on the future of the SE Qld property market. I regularly read your comments and forum members hold your financial advice in high regards.

I am in the process in financing the purchase of my third property. Interesting times indeed.

Regards

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

Brisbane vacancy rate on the increase, but still low. This is especially true in the CBD where there seems to be an influx of new higher end apartments

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

Update:

The rental situation is as tight as it gets up here at the moment. The lack of new house construction over the past 5 years has lead to a severe shortage on the market. With over 10,000 new jobs created over the past year within the Sunshine Coast region the demand cannot keep up with supply. And it's only set to increase with construction making up for lost time. Tourism is back,the sun is out, and the people are coming. The perfect investor storm is about to happen! Minus the rain..

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

Be wary about all this marketing fluff. There's a storm brewing and while things might seem rosy at the moment there are way too many downwards pressures on the economy to start getting ahead of oneself.

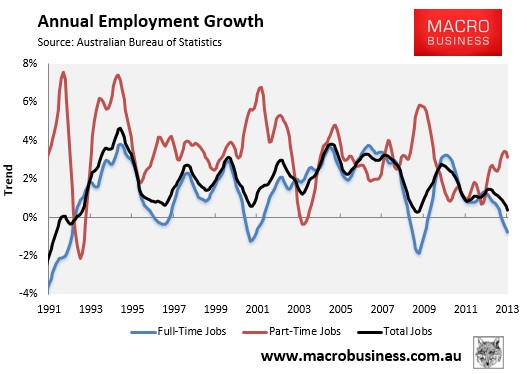

The employment picture is changing and rapidly. Full time job growth is crashing and part time employment is contracting. AU needs to generate 1000+ jobs per day just to keep up with population growth let alone replacing lost jobs.

Thanks for your comments Freckle. I was wondering if you were going to throw in your two cents.

I am well aware of your views on the worldwide economic climate. It is interesting though to note that the figure you have posted hardly strays away from a 20 year historical fluctuation in average employment growth/decline. Far from supporting your claims of 'changing rapidly'.

It seems the employment trend is switching from an even full-time/ part-time spread to a decline in full-time and increase in part-time employment.

Tourism is is an industry heavily dominated by a short-term, migratory workforce on part-time employment conditions. Could this be evidence of a transitional shift and a growing demand for employment within this sector? Food for thought..

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

QLD Govt Industry job trends and statistics

Trend employment in Queensland rose 0.1% in December

2013. Employment in trend terms has now risen in 14 of the

last 15 months (see Chart 1). Over the year to December,

trend employment grew 35,200 persons, accounting for

around three quarters of national jobs growth. This was driven

by a 38,800 increase in part-time employment, while full-time

employment fell 3,600. Today’s results show that Queensland

recorded the strongest trend employment growth of any State

over the year to December 2013 (Table 2).

The problem trend to watch here is that full time jobs are being lost while part time (often low paid) jobs are growing. What full time job growth there is mainly features highly skilled occupations and industries. These sectors don't tend to employ large numbers of people. I have a problem with the construction and mining sectors suggested by QLD Gov due to the huge drop off in CapEx as the mining expansion continues to wind down. I've never been a huge fan of state treasury predictions especially after the poly's have had a go at them.

Industries expected to record employment growth to 2016–2017 include:

- health care and social assistance

- professional, scientific and technical services

- construction

- mining.

These industries are forecast to provide more than 60% of employment growth in the next 5 years. Growth is also likely in those jobs that require higher skill levels (e.g. Bachelor degrees, advanced diplomas).

I definitely wouldn't bank on these projections. I would think a gradual increase in unemployment is far more likely.

Australia

You can build thematic maps here that give very good breakdowns of employment across QLD. SE Qld is quite detailed

http://statistics.oesr.qld.gov.au/qld-thematic-maps

Interesting tool.

"All other capital cities are likely to do better than last year. The best performer in Australia is likely to be Brisbane and Queensland markets in general. Queensland’s diverse economy is beginning to move forward. Further, the reducing value of the Australia dollar will help the tourist industry in this market, which will in turn provide increasing job opportunities"

John Edwards, February, 2014

Shame our dollar continues to remain stubborn. Says a lot about the underlying strength of our economy despite the reduction in mining CapEx (which was always going to happen), loss of manufacturing jobs, shift in employment etc

It seems there are a lot of positive signs for QLD markets over the next 5 years. I'm not buying into this Chinese economy contraction and its devastating effect on our own markets. It's just smoke and mirrors.

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

sciencesurf wrote:Shame our dollar continues to remain stubborn.Why? NZD has risen substantially against both the AUD and USD yet exports have risen. The idea that currencies should be devalued to remain competitive is a furfy.

Quote:It seems there are a lot of positive signs for QLD markets over the next 5 years. I'm not buying into this Chinese economy contraction and its devastating effect on our own markets. It's just smoke and mirrors.Back it up with some reasoning or you're just waffling.

Freckle,

I was initially quite annoyed with your passive aggressive comments asking me to back up my opinions. I have been regularly reading this forum for a year now, and love the content – including your extreme views on just about everything. I especially liked your claims of robots taking over the workforce, with the included picture of a burger flipper. Classic.

I am passionate about property investing and therefore decided to join in the discussions to hear other peoples views about the property market I am invested in. I did not join to have my opinions, just opinions, discredited by claims of waffling.

Not every statement needs to be backed up by statistical analysis and charts. Working in the science field I understand the need for measured data to provide support for an observed event or process. But in terms of data supporting this Chinese rollercoaster everyone is on, I'm not biting. The future is not observable and only time will tell. Plus the old trading line comes to mind 'What you least expect to happen is what will often eventuate'.

In particular, I am not 'buying' into the contraction of the Chinese economy and its effect on our property markets, because, put simply.

I'm not interested in CYCLES. My strategy is BUY and HOLD and long term at that.

We have fantastic serviceability, highly secure employment and most importantly

MONEY naturally devalues over time.Work with the system not against it.

And after all that, if you still need your 'fix' of statistics, have a read of Pete Wargents' article responding to Harry Dent's claims in his latest public offering.

Fantastic blogger, in my opinion

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

People usually try and justify their opinion right or wrong. First time I've ever seen someone justify waffling.

I'm often amused by people who offer an opinion and when asked why they say 'because'.

sciencesurf wrote:Working in the science field I understand the need for measured data to provide support for an observed event or process. But in terms of data supporting this Chinese rollercoaster everyone is on, I'm not biting.I watched a doco some years ago that explored why some people survive disasters and others don't. Apparently the studies consistently show that survivors understood unfolding events and interpreted the potential threat long before others and took the requisite action to protect themselves or move out of harms way.

In terms of financial disasters some dumb as chips muppet has to be holding the bag when things go south.

I'm as certain as one can be that things aren't going to work out for many and if things do go as I expect then its people like yourself that will say…'never saw that coming'. The worst that can happen to me is I'll just be wrong. The worst that could happen to you is you loose your shirt. I only have to be right once. You have to be right every day.

I'm sure everything's alright in China and the data is just a head fake..

Lehman's triggered the last GFC because they weren't bailed out. China has a 1000 Lehman's coming due over the next 12 months but I'm sure everything will sort itself out.

sciencesurf wrote:The guys a tosser.

…Anyway, must log off, heading to Darling Harbour for a swanky Indian restaurant lunch* at Zaaffran. It’s what we do around here, y’know…

Tossers who know what they're talking about are barely tolerable but this guy is just another waffler. It's the kind of feel good drivel the MSM dishes out to make the masses feel good.

You will get used to Freckle he bashes everyone just check out my posts on America lol.

You can make many in any market so it depends on your strategy. If you are trading there maybe good opportunities to make money. Markets like the Sunshine cost tend to be boom and bust. I believe that in Australia if you invest in major cities you investment should provide you with solid growth and also low vacancy.

I think Brisbane is still undervalued and if you buy carefully within 10-12km of the city it will be a very safe bet. That not to say that the Sunshine coast could be ok however history has shown that what goes up can quickly go down. Generally fall are not as great when you invest in Prime locations.

Nigel Kibel | Property Know How

http://propertyknowhow.com.au

Email Me | Phone MeWe have just launched a new website join our membership today

Nigel Kibel wrote:You will get used to Freckle he bashes everyone just check out my posts on America lol.Everyone is somewhat of an exaggeration. I prefer to describe it as debunking group think and other mindless musings.

Cheers for your comments Nigel. I tend to agree on Brisbane. It's a market that is plodding along nicely but gaining investment popularity very qiuckly. Nice to have an ally too!

As for Freckles comments….

My investment decisions have not been made lightly. I have spent the last few years soaking up information from all sources, both positive and negative. From extremist views to popularised media plugs.

We bought on the Sunshine Coast at the bottom of a severely depressed market. Our last investment property was bought for $85,000 under its 2007 sale price. We are experiencing extremely high rental yields with demand outstripping supply. And most importantly the Sunshine Coast has an abundance of future economic drivers. And at the top of that list is the multi billion dollar health district at Kawana. A service that will not just disappear at the turn of another GFC.

We have also extensively renovated our PPOR by ourselves. A massive challenge but in effect have lowered our LVR to even safer levels.

I think what you missed is the fact that I believe there will be a downturn one day (ie CYCLES), and yes you will be right, but while your ranting on making it your life mission to convince people of the fact, I will be out their building my future.

I know what it's like to live broke. Three years ago my only asset was the shirt on my back. While you have been carving out your internet dream over the past year I have made $140,000 by investing wisely.

So by dumb as chips muppets – you mean people that invest in property?? Get over yourself.

Economists are guys that know 100 ways to make love but don't know any women.

Freckle wrote:sciencesurf wrote:The guys a tosser.

…Anyway, must log off, heading to Darling Harbour for a swanky Indian restaurant lunch* at Zaaffran. It’s what we do around here, y’know…

.

Glad you picked up on Pete's ironical sense of humour.. Just to clarify, he was talking about Dents' ability to stereotype the Australian culture and housing markets..

sciencesurf

http://sciencesurf.wordpress.com/

Email Me | Phone MeClick my website for the Sunshine Coast Property Blog

sciencesurf wrote:Economists are guys that know 100 ways to make love but don't know any women.

I knew there was a reason I never took economics at uni…

sciencesurf wrote:So by dumb as chips muppets – you mean people that invest in property?? Get over yourself.

Again you show your lack of knowledge, comprehension or understanding. Investing is widely considered to be predicated on the the 'greater fool' theory. It requires someone more foolish than you to purchase your asset for more than you did. Property is an exceptionally good example of that theory although the share market is an equally good example.

Every asset that exists has to be held by someone or some entity. When the value of an asset falls you are either a fool for holding it or a fool for not finding a greater fool to buy it and absorb the losses for you. 90% of people have a zero to barely working understanding of investing and certainly the wider complexities of that art.

I can't exclude myself from this group totally as I have been guilty of being the fool in earlier days and am not yet rid of the odd foolish impulse.

You must be logged in to reply to this topic. If you don't have an account, you can register here.